Syme Share Price Hitting New Lows: Chart Analysis

Table of Contents

Over the past year, the Supply@me Capital Plc. (Syme) share price has fluctuated between a high of 0.135 and a low of 0.01, with a trading range of 0.125. The company has a market capitalisation of £7.24 million and approximately 71.73 billion shares outstanding.

Supply@me is a dynamic player in the Industrial Services sector. With a nominal value of 0.002p, Syme is traded on the London Stock Exchange under the ticker symbol SYME.L.

Syme runs a platform that facilitates inventory monetisation for manufacturing and assists trading firms globally, including in the United Kingdom, the Middle East, Italy, North Africa, and the United States. The firm’s headquarters are located in London, UK.

Syme stock tackles a common issue for businesses with physical goods. Financial institutions have traditionally seen inventory as a risky and fraud-prone asset due to difficulties in monitoring stock levels.

By providing a way for companies globally to access funding based exclusively on the value of their inventory, Supply@Me helps improve their capital position. This access to capital allows businesses to invest and drive growth.

Market Fluctuations: Syme Stock Experiences Significant Decline

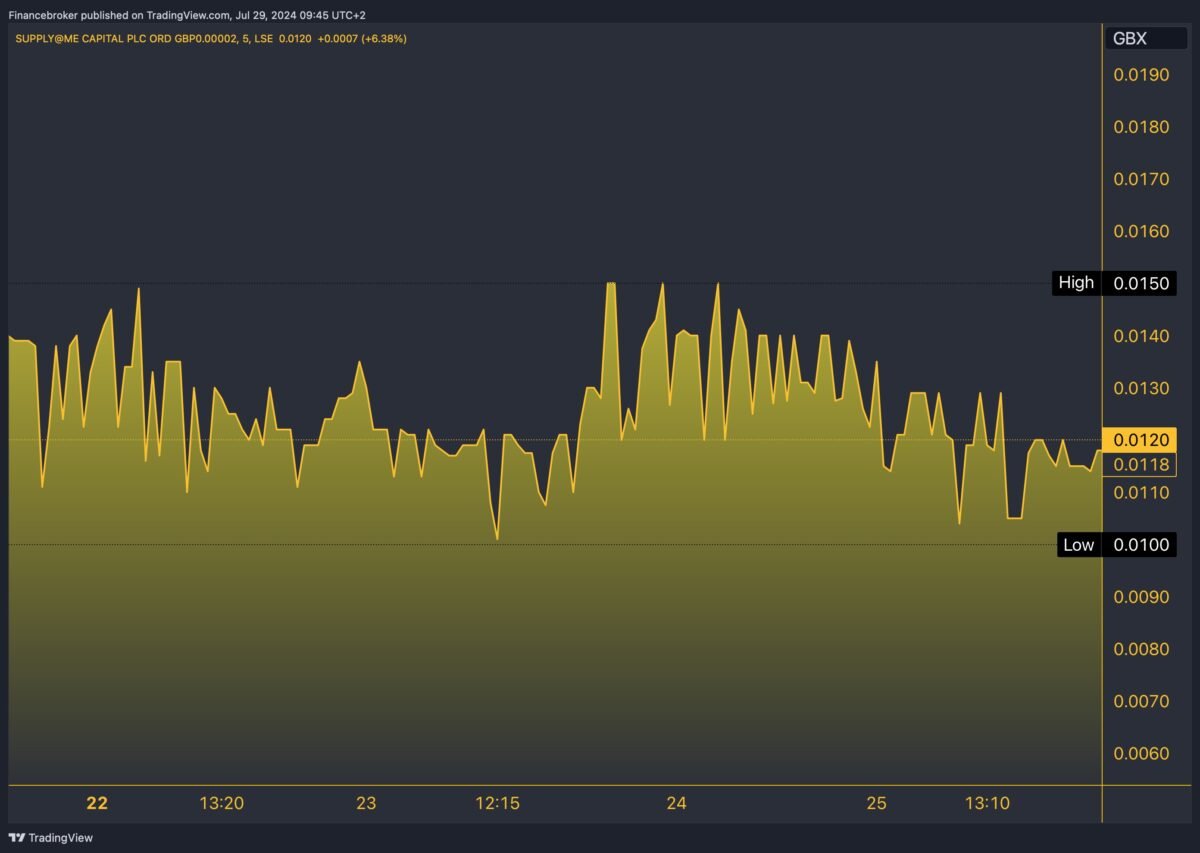

The Syme live share price saw a dramatic fall to 0.0101 GBX, marking a 19.52% decrease from its previous closing price of 0.01255 GBX.

The shares opened at 0.011 GBX, peaked at 0.0111 GBX, and dropped to a low of 0.01 GBX during the trading day.

Recent trading activity revealed high volumes, with 188,402,073 shares changing hands. The current bid stands at 0.0101 GBX. Meanwhile, the demand price is 0.0129 GBX, illustrating notable volatility in the stock.

Over the past year, Supply@me Capital’s share price reached a 52-week high of 0.135 GBX on July 31, 2023, and a low of 0.01 GBX on July 23, 2024. The stock price has been particularly unstable over the last three months, reflecting broader market uncertainties and specific company challenges.

The company’s market capitalisation is £7.24 million, with 71.73 billion shares outstanding. With a P/E ratio of -1.383562 and earnings per share at -0.0073 GBX, the financial metrics highlight the company’s current challenges. In recent trading activity, there were 45 transactions, with 125,584,008 shares sold for £13.53k and 62,818,065 shares bought for £7.27k.

Syme shares do not offer a dividend, resulting in a yield of 0.00%. The market size for its shares is 7,500,000, indicating a relatively modest market capitalisation compared to peers.

As Syme continues to face financial challenges, investors are closely monitoring its performance and the broader market conditions for future developments.

Syme/GBX 5-Day Chart

Syme Share Price Forecast: Potential For A Bullish Turnaround?

According to the Syme share price chart data, significant volatility and uncertainty surrounds the company’s prospects. Syme share price prediction has a challenging environment, with expectations of a sharp decline to 0.0101 GBX.

Coupled with a 19.52% drop from its previous close, this highlights the ongoing difficulties the company faces. The P/E ratio of -1.383562 and negative earnings of -0.0073 GBX further suggest persistent financial struggles.

With a market capitalisation of £7.24 million and 71.73 billion shares outstanding, Syme stock is navigating a low-cap environment, which may limit its financial flexibility and market influence. However, the substantial trading volumes and recent fluctuations indicate that investors are actively engaged.

Besides, there is potential for recovery if the company can improve its financial performance or leverage its inventory monetisation platform effectively. In the near term, the stock may continue to experience volatility due to broader market conditions and company-specific challenges.

However, if the company stabilises its operations and demonstrates positive financial progress, the Syme share price target could reach its upward aim. Conversely, ongoing issues or adverse market conditions could lead to further declines.

The 52-week high of 0.135 GBX and low of 0.01 GBX underscore the stock’s potential for significant price movement. Investors should watch for any announcements related to financial performance or strategic initiatives that could impact the stock’s direction.

Overall, while the stock’s current trajectory suggests caution, opportunities for recovery exist depending on future developments and market dynamics.