FTSE 350: Top Risers and Fallers

Table of Contents

The FTSE 350 index is a stock market index that includes both the FTSE 100 and the FTSE 250. The FTSE 100 represents the top 100 companies by market capitalisation, while the FTSE 250 covers the next 250 companies. Together, they make up the FTSE 350, which comprises 350 stocks listed on the London Stock Exchange (LSE).

The Financial Times Stock Exchange (FTSE) updates this index, and it is owned by the London Stock Exchange Group, headquartered in the United Kingdom. This group provides index offerings to financial markets worldwide, which taders can use as benchmarks globally.

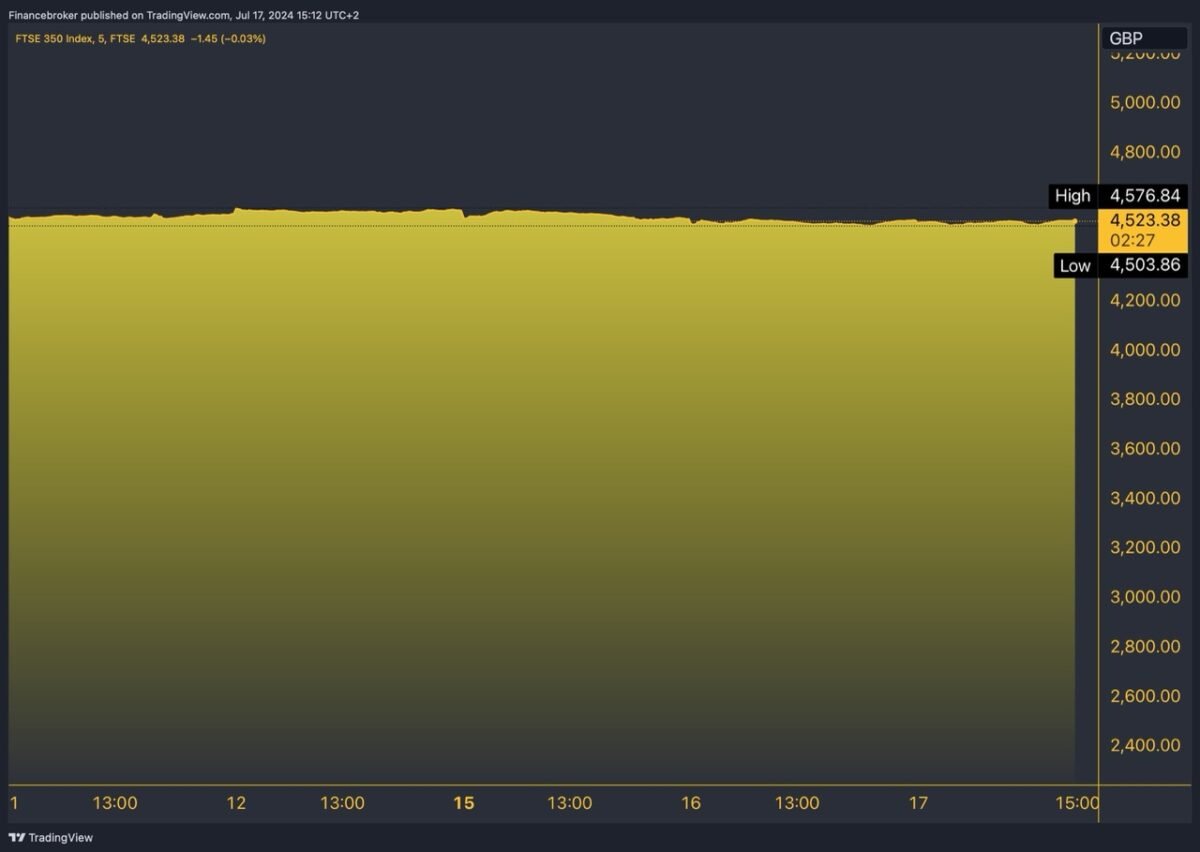

Today’s FTSE 350 share price is at 4,517.25, showing a slight decrease of 0.16%. Alongside this, we have an updated list of the top FTSE 350 risers and fallers.

FTSE 350 5 Day Chart

Top 5 Risers:

BARCLAYS PLC (2.12%)

Abrdn plc (1.90%)

Pennon Group (1.85%)

Alfa Financial Software Holdings Ltd (1.67%)

Close Brothers Group plc (1.45%)

Top 5 Fallers:

Genus PLC (GNS) (-5.15%)

ANTO Antofagasta PLC (-3.38%)

FOUR 4imprint Group PLC (-2.27%)

OXIG Oxford Instruments PLC (-1.71%)

PCT Polar Capital Technology Trust Plc (-1.63%)

FTSE 350 Market Overview

Recent movements within the FTSE 350 index highlight the dynamic nature of market performance. For instance, Ocado Group PLC (LSE: OCDO) has gained 8% and an additional 14% in the last 5 days.

If Hargreaves Lansdown PLC (LSE: HL), which fell back into the FTSE 250 last year, gains bid interest, it is expected to recover. At the same time, the developer of residential buildings, Vistry Group PLC, the former Bovis, will be among the FTSE 350 fallers, with its shares down 4.5% today.

US Stocks

Most Wall Street stocks are opening higher despite the Dow Jones industrial down 0.25% from health stock issues.

The Nasdaq Composite is up by 0.2% with an almost 5% jump of Nvidia being the major factor that led Nasdaq. On the other hand, the S&P 500 is trading higher at first, but it has turned flat.

Apple, Alphabet, and ASML are the only ones with positive signs in the Nasdaq, though they aren’t the only ones in the Nasdaq’s top 15. Along with the FTSE 100, the chief European go-downs are also in the negative, mainly coming up. The DAX is close to the line, whereas French CAC is at its worst, losing 0.6%.

Steps to Trade or Invest in the FTSE 350

You can choose one of the two options to open a position to trade the FTSE 350. They will give you the exposure to have a 350-share portfolio in one position.

First, use a shared currency account to buy and own physical FTSE 350 stocks on the LSE. It is also possible to invest in FTSE 350-related ETFs.

Another way to trade is by using derivatives such as spread bets and CFDs. These tools allow for straightforward bets and are essential for speculating on both rising and falling markets. They also require you to use a buy-to-close option.

FTSE 350 Review 2024

Last year, rates did not hit the highest level until August, if they did at all. Once again, the UK equity market’s performance was poor, especially for smaller companies, and the FTSE 350 lost 3.8% of its value. On the contrary, the economy has proven more robust than initially believed.

So far, the FTSE 350 household goods & home construction sector has a 16% trend last year. Meanwhile, the average retailer is close to a double-digit return.

However, while we must analyse the index sector by sector, we must remember that in-depth research is always necessary. When examining any categorisation on these pages, the risks from the past year will be noticeable. The tendency to condemn the UK market at the year’s end has been a constant principle for over a year.

Consider the average price return of the 20 best shares in the index last year for a rough illustration of this.