Analyzing Forex Silver Charts: Trends, Insights & Strategies

Table of Contents

People who are interested in the Forex market should learn as much as possible about Forex-related topics, such as Forex silver charts and Forex chart patterns.

What can we say about Forex chart patterns?

It is desirable to remember that Forex chart patterns are visual tools traders use in order to predict future price movements based on historical data. Interestingly, these patterns emerge from the collective behavior of market participants and reflect trading psychology.

Is it so important to recognize the patterns mentioned above?

By recognizing the patterns mentioned earlier, traders can make better decisions about when to enter or exit trades. Let’s gather more information about Forex silver charts and Forex chart patterns.

Reversal patterns

We can start our journey in the world of Forex chart patterns with reversal patterns.

Traders should remember that reversal patterns indicate that the current trend will likely change direction. As a reminder, reversal patterns typically form after a considerable price movement. Reversal patterns suggest a potential trend reversal.

Head and shoulders

What is the purpose of a head and shoulders pattern?

It signals a reversal from an uptrend to a downtrend. One important fact is that a head and shoulders pattern consists of three peaks: the middle peak (head) is higher than the two outside peaks (shoulders).

The neckline is drawn by connecting the lows of the two shoulders. When the price falls below the neckline, it signals a potential bearish reversal.

Inverse head and shoulders

What about an inverse head and shoulders pattern?

An inverse head and shoulders pattern suggests a reversal from a downtrend to an uptrend. This pattern consists of three troughs: the middle trough (head) is lower than the two outside troughs (shoulders).

What happens when the price surpasses the neckline?

It signals a potential bullish reversal.

Double top and double bottom

Double top? What is its purpose?

This pattern forms after a strong uptrend and suggests a bearish reversal. The double top pattern consists of two peaks at roughly the same level with a trough in between.

When the price falls below the support level (the trough), it signals a potential bearish reversal.

Now, let’s discuss the double bottom pattern.

A double bottom pattern forms after a strong downtrend. This pattern signals a bullish reversal.

This pattern is made up of two troughs at roughly the same level with a peak in between. When the price surpasses the resistance level (the peak), it indicates a potential bullish reversal.

triple top and triple bottom

What’s interesting is that the triple top pattern is similar to the double top. However, the triple top pattern has three peaks at roughly the same level.

We must also note that a triple top pattern signals a bearish reversal when the price breaks below the support level.

The triple bottom pattern is similar to the double bottom pattern. However, this pattern has three troughs at roughly the same level. What does a triple bottom pattern signal?

This pattern signals a bullish reversal when the price breaks above the resistance level.

Continuation patterns

We can’t forget about continuation patterns when it comes to Forex silver charts and Forex chart patterns.

What makes continuation patterns so important? Let’s find out!

Continuation patterns suggest the current trend will continue after a brief consolidation period. Traders should keep in mind that continuation patterns usually occur during pauses in a prevailing trend and indicate that the trend will likely resume.

Flags and pennants

Bullish flag: Importantly, a bullish flag pattern forms during an uptrend. This pattern is characterized by a small rectangular consolidation period that slopes against the prevailing trend. When the price breaks above the flag, it signals a continuation of the uptrend.

Bearish flag: This pattern forms during a downtrend. It has a small rectangular consolidation period that slopes against the prevailing trend. When the price falls below the flag, it signals a downtrend continuation.

Bullish pennant: Similar to the bullish flag but with converging trend lines forming a small symmetrical triangle. Interestingly, this pattern indicates a continuation of the uptrend when the price breaks above the pennant.

Bearish pennant: Similar to the bearish flag but with converging trend lines forming a small symmetrical triangle. It indicates a downtrend continuation when the price breaks below the pennant.

Rectangles

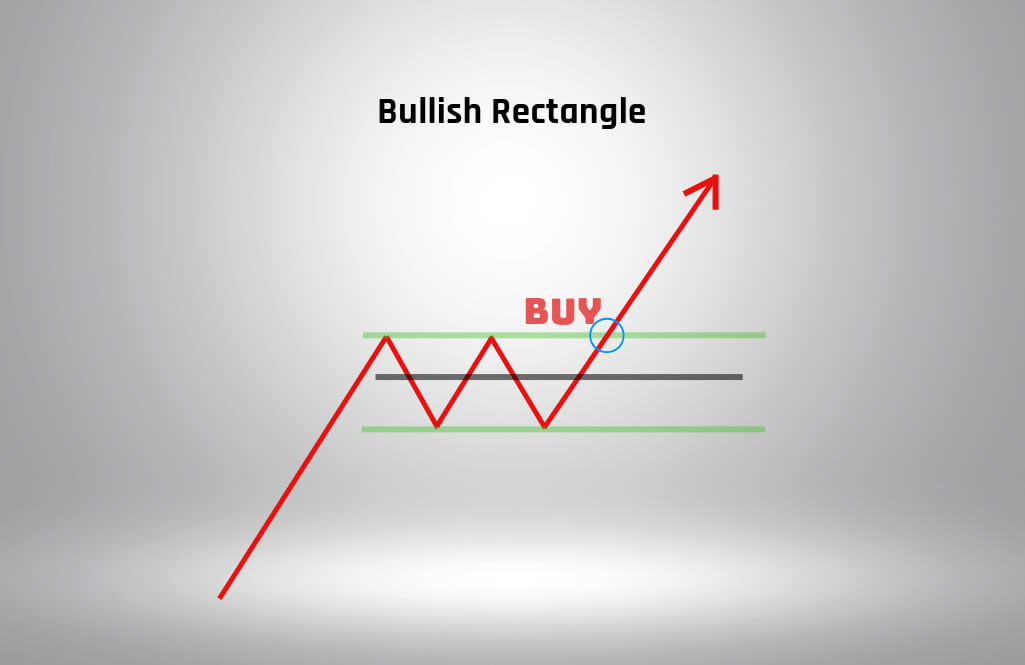

What is the purpose of a bullish rectangle and a bearish rectangle?

The bullish rectangle pattern forms during an uptrend and has a horizontal consolidation period between parallel support and resistance levels. When the price exceeds the resistance level, it signals a continuation of the uptrend.

What about a bearish rectangle?

It forms during a downtrend and has a horizontal consolidation period between parallel support and resistance levels. When the price falls below the support level, it suggests a continuation of the downtrend.

Key considerations when using Forex chart patterns

Trades must take into account various factors when it comes to Forex silver charts and Forex chart patterns. Let’s assume you are a trader.

Confirmation: Always wait for confirmation before acting on a chart pattern. This usually means waiting for the price to break through key levels (support, resistance, neckline) with increased volume.

Volume: It is crucial to monitor trading volume. As a reminder, a higher volume on the breakout confirms the validity of the pattern.

Risk management: Traders should be prepared for the worst-case scenario. Place stop-loss orders beyond the pattern’s boundaries to protect against false breakouts.

Time frame: Consider the time frame in which the pattern appears. Patterns on longer time frames (daily, weekly) are more reliable compared to those on shorter time frames (hourly, 15-minute).

Combining patterns with other indicators: Improve the reliability of chart patterns by combining them with other technical indicators. For example, RSI and MACD.

To sum up, Forex chart patterns are powerful tools for predicting potential price movements and making informed trading decisions. By recognizing and interpreting these patterns, traders can identify potential entry and exit points and manage their trades more effectively.

Nevertheless, using chart patterns with other technical analysis tools and risk management strategies is important to increase the probability of successful trades. Understanding and applying these patterns can significantly enhance a trader’s ability to navigate the complexities of the Forex market.