Advantages of CFD Trading: Key Benefits for Traders

Table of Contents

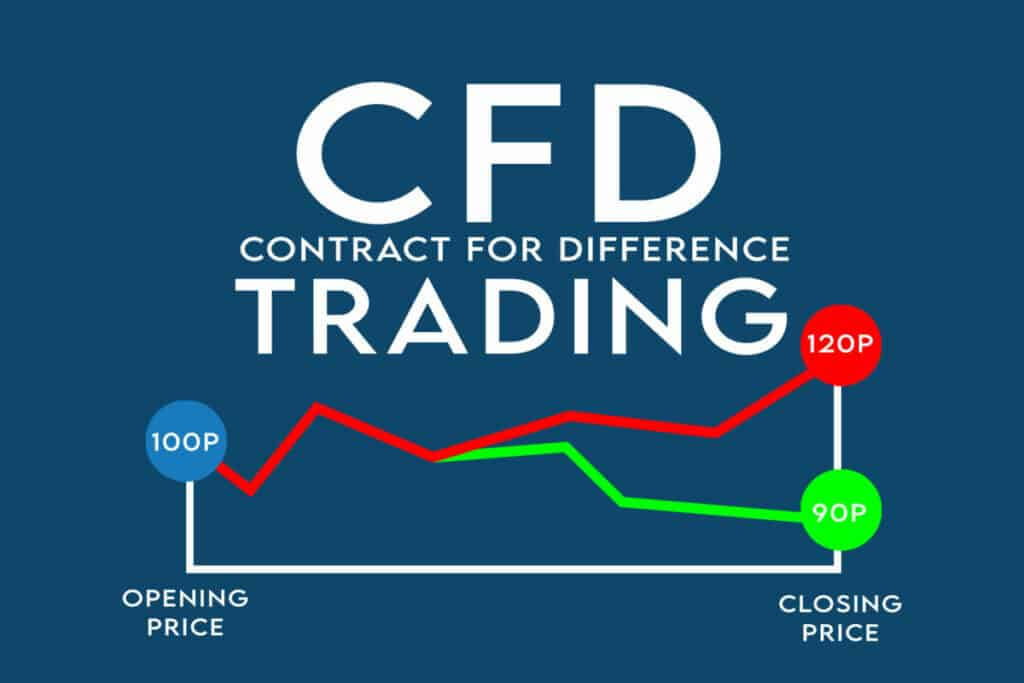

It is no secret that contract for difference (CFD) trading has gained significant popularity in the financial markets over the past two decades. What are the main advantages of CFD trading? Let’s find out!

The first task is to define what a CFD is. To cut a long story short, it is a financial derivative that allows traders to speculate on the price movements of various assets without actually owning the underlying asset. Sounds interesting!

Unsurprisingly, this form of trading offers a unique set of advantages and disadvantages, making it vital for traders to understand its intricacies before participating.

One of the most popular questions is, “What are the main advantages of CFD trading?” Let’s discuss some of the main advantages.

Leverage and margin trading

Without a doubt, one of the main advantages of CFD trading is the ability to trade on margin. This means traders can open positions much larger than their initial capital outlay.

Access to a wide range of markets

The list of advantages is pretty impressive.

CFD trading offers access to a diverse array of markets and financial instruments. For example, stocks, commodities, indices, Forex, as well as cryptocurrencies. This wide range allows traders to diversify their portfolios.

Besides, CFDs provide opportunities to trade global markets from a single platform, enabling 24/7 trading in various assets.

This versatility allows traders to participate in numerous asset classes. The list includes stocks, indices, commodities, cryptocurrencies and Forex, all from a single trading platform.

Stocks and indices: CFDs on stocks and indices allow traders to take positions on individual company shares or entire market indices like the S&P 500. Thus, traders have the ability to capitalize on broad market movements or specific sector trends.

Commodities: CFD trading includes popular commodities. Sounds good!

Traders have the opportunity to speculate on price changes driven by supply and demand dynamics, geopolitical events, or macroeconomic trends.

Forex: The Forex market is the largest financial market in the world. What’s interesting, the world’s largest financial market is accessible through CFDs, offering pairs like EUR/USD, GBP/JPY, and other currency pairs.

Last but not least, Forex CFDs provide opportunities to trade currency fluctuations influenced by economic data, global events, among other factors.

Cryptocurrencies: CFDs also allow traders to enter the cryptocurrency market without needing to manage digital wallets or exchanges. Importantly, this includes major cryptocurrencies like Bitcoin, Ethereum, etc.

Main advantages of CFD Trading (part two)

There is no lack of advantages. Let’s stay focused on the main advantages of CFD trading.

No stamp duty

In the case of some countries, trading CFDs can be more tax-efficient compared to traditional stock trading. People may ask, “Why?”

We need to note that CFDs don’t involve purchasing the underlying asset. This means that traders don’t have to pay stamp duty, which can be a significant cost saving.

Profit from rising and falling markets

CFD trading allows traders to take both long (buy) and short (sell) positions, enabling them to profit from both rising and falling markets. This flexibility is extremely important when it comes to volatile markets where prices can fluctuate rapidly.

By short-selling, traders have the opportunity to capitalize on market downturns, which isn’t possible with traditional buy-and-hold strategies.

Hedging capabilities

It is possible to use CFDs in order to minimize losses. For example, if a trader holds a substantial amount of shares in a company and anticipates a short-term decline in its stock price, they can open a short CFD position to offset potential losses. What’s important, this ability to hedge effectively adds a layer of risk management to the trading strategy.

No expiry dates

As opposed to options or futures contracts, CFDs don’t have expiry dates. This means traders can hold their positions for as long as they choose, provided they can meet the margin requirements. This flexibility allows for both short-term trading and long-term investment strategies.

Direct Market Access

A number of CFD brokers offer direct market access (DMA), allowing traders to place orders directly into the underlying market. It is noteworthy that DMA also provides greater transparency and control over trading strategies.

Disadvantages of CFD Trading

Traders should also take into account the disadvantages of CFD trading.

While leverage can amplify profits. However, it also magnifies losses. Trading on margin means that a relatively small adverse price movement can result in substantial losses, potentially exceeding the initial capital investment.

Complexity and learning curve

CFD trading involves a steep learning curve and a higher complexity level than traditional stock trading.

Traders should learn more about various aspects, such as margin requirements, leverage, and the CFD market, in general. Inexperienced traders may find it challenging to grasp these concepts, leading to potential mistakes and losses.

Overnight financing costs

Holding CFD positions overnight incurs financing charges, often referred to as swap rates. These costs can add up over time, especially for long-term positions, reducing overall profitability.

So, traders must factor in these charges when calculating potential returns and should be aware of the impact on their trading strategy.

Market volatility and liquidity risks

CFD markets can be extremely volatile, with rapid price fluctuations that can lead to sudden and significant losses. Furthermore, low liquidity in certain markets can result in slippage, where the execution price differs from the expected price. This can affect trading outcomes, particularly during times of high market stress or low trading volume.

Counterparty risk

CFDs are over-the-counter (OTC) products. As a result, CFDs aren’t traded on a centralized exchange but directly between the trader and the broker. This introduces counterparty risk, where the trader relies on the broker’s financial stability and integrity. If the broker fails or becomes insolvent, the trader may face difficulties in recovering their funds.

Regulatory risks

CFD trading is subject to varying regulatory environments across different jurisdictions. Regulations differ from country to country.

It is important to remember that changes in regulatory policies can impact the availability and terms of CFD trading, potentially affecting traders’ ability to operate in certain markets.

Psychological pressure

The fast-paced nature of CFD trading, coupled with the use of leverage, can create significant psychological pressure. Traders may experience stress and anxiety, leading to impulsive decisions and emotional trading. It is vital to have a trading plan and to manage the psychological challenges associated with CFD trading.

To sum up, the advantages of CFD trading outweigh the disadvantages. Nevertheless, it also comes with substantial risks, such as high leverage risk, complexity, overnight financing costs, and counterparty risk.

Aspiring CFD traders should conduct thorough research and develop a solid trading strategy. They should also practice disciplined risk management to navigate the challenges and maximize the benefits of CFD trading.